- Overview

- Prerequisites

- Enable feature

- Set up an archive task

- Display historical data from the history table

Overview

This post explains how to archive Dynamics 365 Finance tax transaction data.

When you archive tax transactions, the data from the following tables is moved to the history tables:

- TaxTrans

- TaxTrans_BR

- TaxTrans_IN

- TaxTrans_IT

- TaxTrans_RU

- TaxTrans_W

- TaxTransExtensionTH

- TaxTransGeneralJournalAccountEntry

- TaxTransSubledgerJournalAccountEntry

Prerequisites

Verify that your environment is configured to use the archive feature.

In addition, the following prerequisites must be met before tax transactions are archived:

- All periods of the fiscal year must be either permanently closed or on-hold state.

- The company’s previous Tax transactions must be archived.

- The archiving jobs for the different years must be performed in chronological order. For example, the 2018 tax transaction data must be archived before the 2019 tax transaction data.

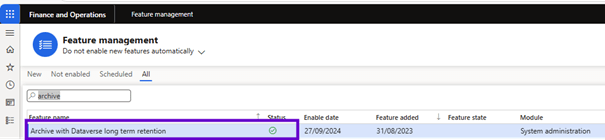

Enable feature

Archive with Dataverse long term retention feature must be enabled.

Set up an archive task

To set up an archive job, follow these steps.

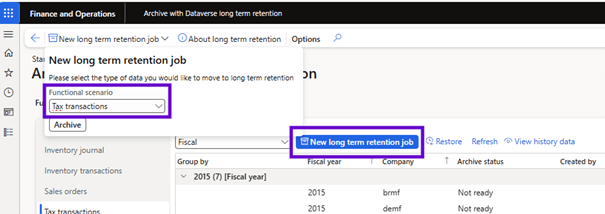

- Go to System administration > Archive with Dataverse long term retention to open the Archive with Dataverse long term retention workspace.

- Select the Tax Transactions functional scenario.

- Select Refresh to enter the fiscal years and the company dataset to archive

Once the period and year-end close are completed on the Tax transaction data for the years and companies, run a refresh. The Ready to Archive status must be Ready before you can plan a new long-term retention job.

- Select New Long-term Retention job to open a wizard that you can use to schedule a new Tax transactions long term retention job.

- Enter a name for the job and select Next.

New long-term retention jobs may be planned for one or more companies at a time. These jobs are performed sequentially.

- On the Define Criteria page, select the combination of fiscal years and companies for which to archive tax transaction data.

- Select Next.

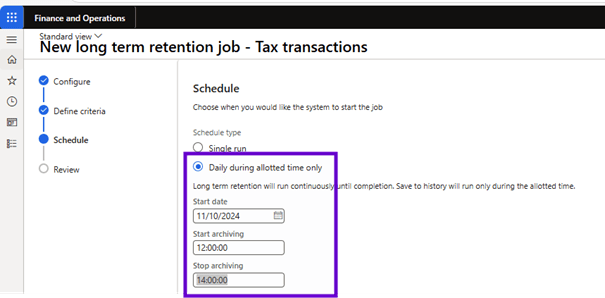

- Select the type of scheduling. Two types are supported:

- Single run: Long-term retention and history saving are performed continuously until both processes are completed. Data is always archived first in the long-term storage of Dataverse. Then, the record in the history tables takes place.

- Daily for the allotted time: Long-term conservation runs continuously until it is completed. The process of saving to history is only executed during the specified archive start and end time.

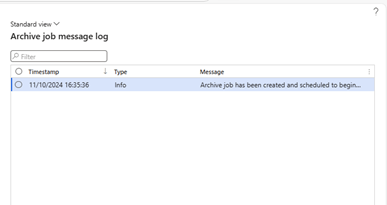

- Select Finish to schedule archiving job for the selected fiscal years and companies.

- Select View Progress to view detailed logs.

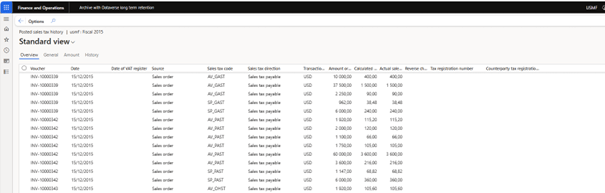

Display historical data from the history table

To view historical transactional details, follow this step.

- Go to Archive with Dataverse long term retention > Tax Transactions and reports > View History Data.

Leave a comment